Strategic Approaches to Home Acquisition

For individuals looking to transition into homeownership but facing challenges with immediate mortgage qualification or a substantial down payment, exploring alternative pathways can be beneficial. Rent-to-own agreements present a structured approach, allowing prospective buyers to lease a property with the option to purchase it at a predetermined price in the future. This method offers a unique blend of renting flexibility and the eventual goal of property ownership, providing a valuable bridge for many aspiring homeowners to achieve their objectives.

Understanding Rent-to-Own Housing Agreements

Rent-to-own housing represents a contractual agreement where a tenant leases a property for a specified period with the exclusive right to purchase it before the lease expires. This arrangement is typically structured in one of two ways: a lease-option or a lease-purchase agreement. In a lease-option, the tenant has the choice, but not the obligation, to buy the home. Conversely, a lease-purchase agreement legally binds the tenant to buy the property at the end of the lease term, assuming all contract conditions are met. Understanding these fundamental differences is crucial for anyone looking to learn about rent-to-own housing.

Key components of these agreements usually include an upfront, non-refundable option fee, which grants the tenant the right to purchase the property. Additionally, a portion of the monthly rent, known as a rent premium, is often credited towards the eventual down payment or purchase price. The purchase price itself is typically agreed upon at the outset of the contract, offering price stability regardless of future market fluctuations. The lease term provides a timeframe for the tenant to improve their financial standing, such as building credit or saving for a down payment, while residing in the home they intend to buy.

Key Considerations for Rent-to-Own Homes

Before entering into a rent-to-own agreement, it is important to gather comprehensive information about rent-to-own homes and consider several critical factors. One significant advantage is the opportunity to enhance one’s credit score during the lease period, making it easier to secure a traditional mortgage when the time comes to purchase the home. Similarly, the rent premium contributed monthly helps accumulate funds for the down payment, easing the financial burden of a large lump sum payment.

Prospective buyers should carefully review the contract to understand their responsibilities regarding property maintenance and repairs, as these can vary significantly between agreements. Some contracts may stipulate that the tenant is responsible for all repairs, similar to a homeowner, while others may place this burden on the landlord. It is also vital to understand the terms of the purchase, including any clauses related to defaulting on payments or deciding not to proceed with the purchase. Consulting with a legal professional specializing in real estate can provide invaluable guidance in navigating the complexities of these contracts and ensuring all terms are fair and understood.

Exploring Rent-to-Own Home Options

Finding suitable rent-to-own homes options involves exploring various avenues. Real estate agents who specialize in this niche market can be a valuable resource, as they often have access to properties not widely advertised. Online platforms dedicated to rent-to-own listings also provide a convenient way to search for available properties. Sometimes, homeowners who are having difficulty selling their property through traditional means may be open to a rent-to-own arrangement, making direct negotiation a possibility.

When exploring options, it is essential to conduct thorough due diligence on the property itself. This includes arranging for a professional home inspection to identify any potential structural issues or necessary repairs before committing to the agreement. An appraisal of the property’s value is also advisable to ensure the agreed-upon purchase price is fair and reflects the current market. Understanding the local real estate market conditions can further inform negotiations regarding the option fee, rent premium, and final purchase price, helping to secure a favorable agreement.

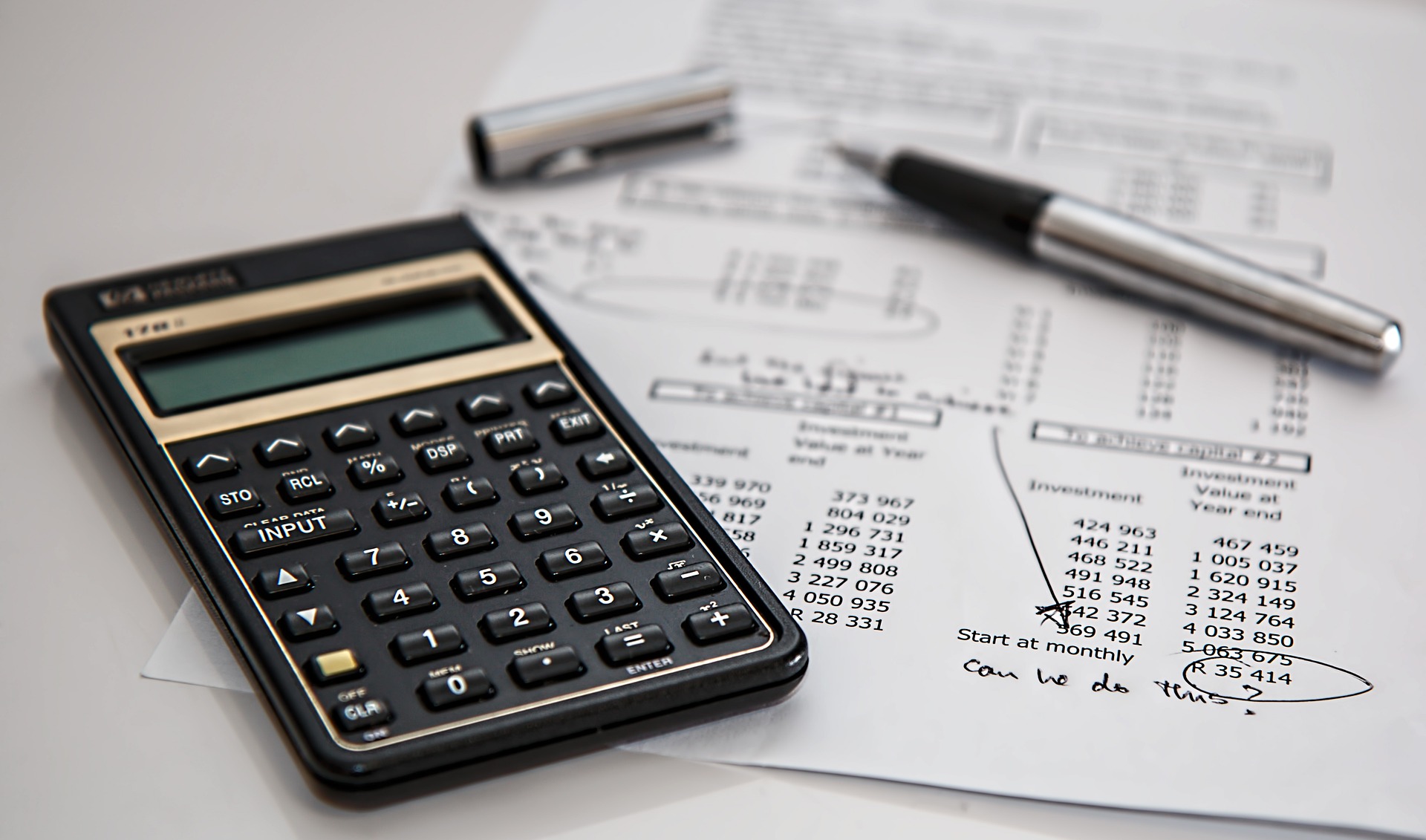

Navigating the financial aspects of a rent-to-own agreement requires understanding the various costs involved. The initial option fee typically ranges from 1% to 7% of the home’s total purchase price. This fee secures the buyer’s right to purchase the property and is usually non-refundable. Monthly rent premiums, which are amounts added to the standard rental payment and credited towards the purchase, can vary from $50 to $300 or more, depending on the property’s value and local market conditions. Additionally, prospective buyers should budget for a home inspection and appraisal during the lease term, as well as potential closing costs, which generally range from 2% to 5% of the loan amount when the purchase is finalized.

| Product/Service | Provider | Cost Estimation |

|---|---|---|

| Option Fee | General Market | 1% to 7% of Home Value |

| Monthly Rent Premium | General Market | $50 to $300 (added to standard rent) |

| Home Inspection | Local Services | $300 to $600 |

| Appraisal Fee | Local Services | $400 to $700 |

| Closing Costs (at purchase) | General Market | 2% to 5% of Loan Amount |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Rent-to-own agreements offer a strategic pathway to homeownership for individuals who may not be ready for a traditional mortgage immediately. By providing a period to improve financial standing and accumulate a down payment, these arrangements can make home acquisition more accessible. Success in a rent-to-own scenario largely depends on a thorough understanding of the contract terms, diligent property evaluation, and consistent financial planning. It represents a structured approach that can empower many to achieve their goal of owning a home.